|

I finished the third chapter of Macroeconomics today as part of my A.E. Project, which focused on business cycle measurement. It discussed the the inherent irregularity and deviations from trend among macroeconomics variables.

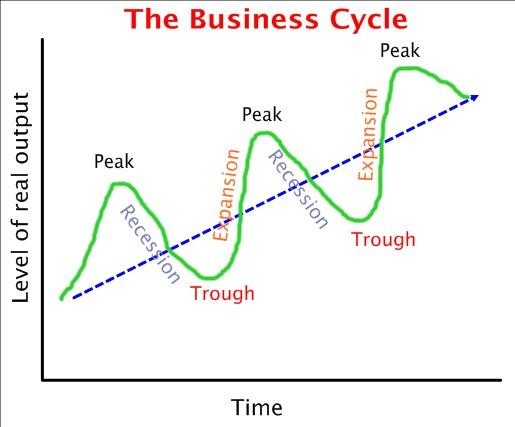

All this is summarized in the picture above. The straight blue line is the long-run trend line for output. The irregularity and deviation from trend is represented by the green line which goes up and down in peaks and troughs. If you've been reading my posts lately, this picture should look extremely familiar! It looks exactly like the pattern seen with progressive overload in performance development over time. Thought Experiment We control physical development over time by inducing higher and higher loads of stress on the body in controlled, incremental fashion and then allowing rest and recovery to take place. As the body recovers, it adapts to the stress it suffered from during the training session by overcompensating in the form of added muscular tissue, enzymes, bone density, and rate coding in neurons. This ensures that any future stress of the same intensity will be handled without much of a shock to the system. If economic growth follows the same curve over time, why can't we manipulate it the same way we do with strength training through shocks to the system? Rather than waiting for irregular and uncontrolled deviations from the long-run growth trend, why not induce systematic shocks to the economy to ensure controlled growth? I understand that the Fed does manipulate interest rates in an attempt at controlling growth. However, I am suggesting that, just maybe, it ought to intentionally create small economic dips, where growth actually reverses slightly, rather than just slow the growth rate. This could hypothetically act the way controlled burning does within the field of forest management. Both forests and the economy are complex systems. Fires are a natural part of the ecology of forests and recessions (troughs) are a natural part of the economy. Rather than wait for fuel buildup to occur (think sub-prime mortgages in the recent recession), it is time we think about taking the recessions into our own hands in the same way fire authorities have taken wildfires into theirs. Nassim Taleb discussed a very similar idea in regards to Switzerland's economy based on small businesses which fail (burn up) often, preventing larger economic problems (wildfires) for the economy as a whole in his book Antifragile - one of the best books I've ever read. Dips will happen with or without planning. Fire authorities and meat-head gym rats understand this. Why don't economists?

1 Comment

anks for sharing the article, and more importantly, your personal experience mindfully using our emotions as data about our inner state and knowing when it’s better to de-escalate by taking a time out are great tools. Appreciate you reading and sharing your story since I can certainly relate and I think others can to

Reply

Leave a Reply. |

Archives

November 2017

|

RSS Feed

RSS Feed